Digital Finance Summit

Digital Finance Summit

-

Fu Xiaozhen

MYbank

Head of Corporate Finance Design

Fu Xiaozhen

MYbank

Head of Corporate Finance Design

From the mobile phone system, e-commerce platform, wealth management platform to the current bank design, there are many industries from the design of the big platform from 0-1, is now responsible for the design of online business bank wealth management and corporate finance, from the previous To C financial management platform design to To B small and micro financial services experience platform, is gradually building a set of service for small and micro enterprises experience architecture system.

-

Gao Ming

ICBC

User Experience Leader

Gao Ming

ICBC

User Experience Leader

She is now the general manager of the user experience department of the Business Research and Development Center of Industrial and Commercial Bank of China. She has been engaged in financial product research and development for 15 years. She has rich experience in project research and development and user experience design team management. Facing users and grassroots, she is committed to creating a people-oriented, flexible and ultimate product experience, enabling financial product project research and development and improving the bank wide experience.

The user experience design team led by her focused on the professional vision of "feeling what users feel and exceeding what users expect", and was at the forefront of the industry in system construction, methodology application and experience innovation, constantly helping to improve the banking product experience under the digital transformation.

-

Chen Ming

China Merchants Bank

Head of Experience Design Team

Chen Ming

China Merchants Bank

Head of Experience Design Team

14 years of experience design experience, more than 7 years of design team management experience, good at building teams from 0-1 and also have the ability to integrate design teams. Years of experience in the design workplace, covering a wide range of fields, providing full-link design solutions to empower business, building a design system to ensure the quality of business design output, precipitating highly recognizable product brand genes, reducing design and front-end development costs and restoring design business Value Essence

-

Zhao Yongchang

HOLA

Co-founder

Zhao Yongchang

HOLA

Co-founder

Engaged in the user experience industry for 14 years. With 8 years of experience experience design and management experience and 6 years of experience in enterprise customer experience consulting services, he has served Tencent, ByteDance, China UnionPay, Industrial and Commercial Bank of China, China Construction Bank, China Merchants Bank, Minsheng Bank, China CITIC Bank, Industrial Bank, Bank of Beijing, Bank of Jiangsu, Chinese Bao, to achieve experience pricing strategies under digital transformation for enterprises at different stages of development, including consumer insight, user experience, trend research, etc. in many fields of research and services. Respect the truth, use retroactive thinking to explore and understand the world, and provide new value and meaning for people's lives.

-

度小满金融(原百度金融)设计总监,度小满金融用户体验中心负责人,原百度地图UX团队负责人,百度首席设计架构师,O2O产品体验设计专家。2010年搭建百度用户研究团队和百度用户体验实验室,2011年起专注于O2O互联网产品的体验设计和研究。2016年加入百度金融服务事业群,组建金融用户体验设计团队。

The Internet of Everything builds financial digital intelligence

At present, the digital economy is booming, from consumer interconnection to industrial interconnection, from the physical world to the digital world, the ultimate digital era of the financial industry has arrived. The deep integration of artificial intelligence, cloud computing, Internet of Things, big data, blockchain and other technologies and industries has bred a variety of innovative financial service models and new user experiences, and the digital transformation of the financial industry is developing rapidly. Under the intelligent ecosystem of the Internet of Everything, better connectivity, stronger intelligence and richer scenarios will be the key for financial institutions to build competitiveness in the digital age.

On the other hand, in the increasingly complex world environment and the global response to the challenge of climate change, green finance has also become an important development direction for the financial industry. How financial institutions can achieve their own green and sustainable development is also a challenge.

At this Digital Finance Summit, we invited a number of leaders and experts from financial institutions to share their product project cases, analyze the current market situation with the participants, discuss the future financial development trend, and discuss how to carry out the ubiquitous financial experience design from the perspective of creating win-win services, so as to better stimulate the service industry and serve the social economy.

-

Speech 1:《Smart technology creates new banking experiences》

Speaker:Fu Xiaozhen ( MYbank,Head of Corporate Finance Design)

With the continuous development and progress of digitalization and intellectualization, the banking industry has paid more and more attention to online experience, taking online service as an important user service contact. However, digitalization and online service are not necessarily the best experience mode. Digital banks need to create a new experience different from traditional banks.

As an Internet bank, online commercial banks serve tens of millions of small and micro users who are relatively lack of financial knowledge. How can they better serve them, so that they can get services and good experiences, and make them feel "meticulous". This requires service innovation, technology driven, and experience reengineering. How does online banking integrate to provide for our users?

1、 Cognitive deconstruction lowers the threshold of financial services for users. Through the information deconstruction of users' service access, a cognitive model of "touch to receive" integration is built in the scene to reduce users' cognitive threshold and improve users' service access and cognition.

2、 Technology drives the expansion of financial experience boundary. Through the use of various technologies, we can promote the interactive innovation of banks and improve people's financial service experience.

3、 Active interaction technology builds online service system. Turn the original offline and post event banking service system into real-time service for users in the process, and improve users' service perception and quality through the active interactive service system.

Work Case-

Service contact cognitive model

Service contact cognitive model

-

Data design of agricultural assets under satellite remote sensing

Data design of agricultural assets under satellite remote sensing

-

Online evocation of active services

Online evocation of active services

-

Framework design for wealth products

Framework design for wealth products

-

-

Speech 2:《Listen to the voice of users and focus on the bank experience - user centered whole process user experience improvement scheme》

Speaker:Gao Ming ( ICBC,User Experience Leader)

The banking industry is the pioneer of digital development, and actively chooses digital transformation to achieve high-quality development. ICBC has always adhered to digital development, taking the lead in entering the digital 2.0 stage, accelerating the digital reconstruction of traditional financial models by building the "Digital ICBC" brand, deeply promoting digital transformation, and striving to improve user experience, business efficiency and business value.

Based on the whole process of business R&D of ICBC, this summit speech, centering on "users" and "grassroots", discussed how to organically integrate user experience work practices with various links under the enterprise level, digital business architecture R&D model, and jointly realize the exploration and practice of improving the user experience of banking products.

1. In the context of user experience in the financial industry, explain how to focus on users and how ICBC's user experience work is based on business architecture and business R&D to find the achievement case of the driving force of experience.

2. In terms of empowering the improvement of grass-roots communication efficiency, it describes how ICBC directly reaches the front line, and how it achieves the information high-speed of direct access to the front line by gathering grass-roots voices, linking the specific practice of branch construction.

Work Case-

Case:Polishing high-quality project

Case:Polishing high-quality project

-

Case:ICBC Xingnongtong's "smart" efficiency improvement

Case:ICBC Xingnongtong's "smart" efficiency improvement

-

Method application: user research method

Method application: user research method

-

R&D mode: integration with business architecture

R&D mode: integration with business architecture

-

-

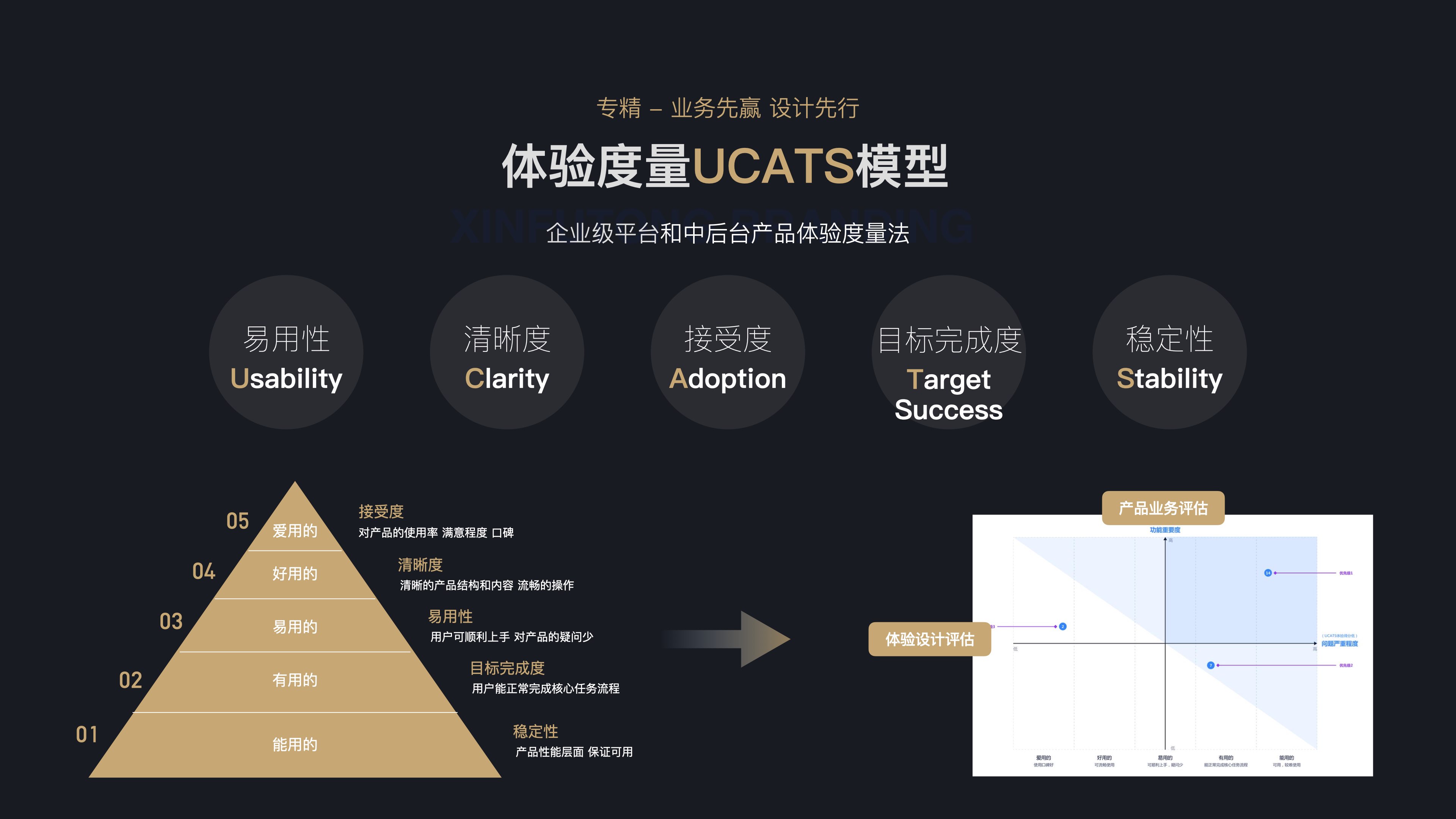

Speech 3:《Change because of you, design first》

Speaker:Chen Ming ( China Merchants Bank,Head of Experience Design Team)

Banks have entered the 4.0 era, and commercial banks have incorporated digital transformation into their core strategies. The maturing of financial technology has reshaped the business model of commercial banks. In an economy that pays more and more attention to experience, experience design work needs to redefine experience design standards under new technologies and new scenarios, create high-quality user experience in the business environment of the financial field, and refine design management to empower the financial field

Create a professional financial design experience and establish an experience design system in the financial field:

1. Business support: business wins first, design first, and expresses experience in the financial field from the perspective of users

2. Professional Development: Design Transformation Global Design Capability

3. Platform support: Build a business design management platform that "improves efficiency and quality" by building financial experience

4. Organizational culture: create a team culture, establish a cross-team, cross-department, professional sharing and co-construction mechanism, and create a design team with high execution, business understanding and positive energy

Work Case-

Design first

Design first

-

Digital beckoning

Digital beckoning

-

Design management platform

Design management platform

-

Experience metrics UCATS models

Experience metrics UCATS models

-

-

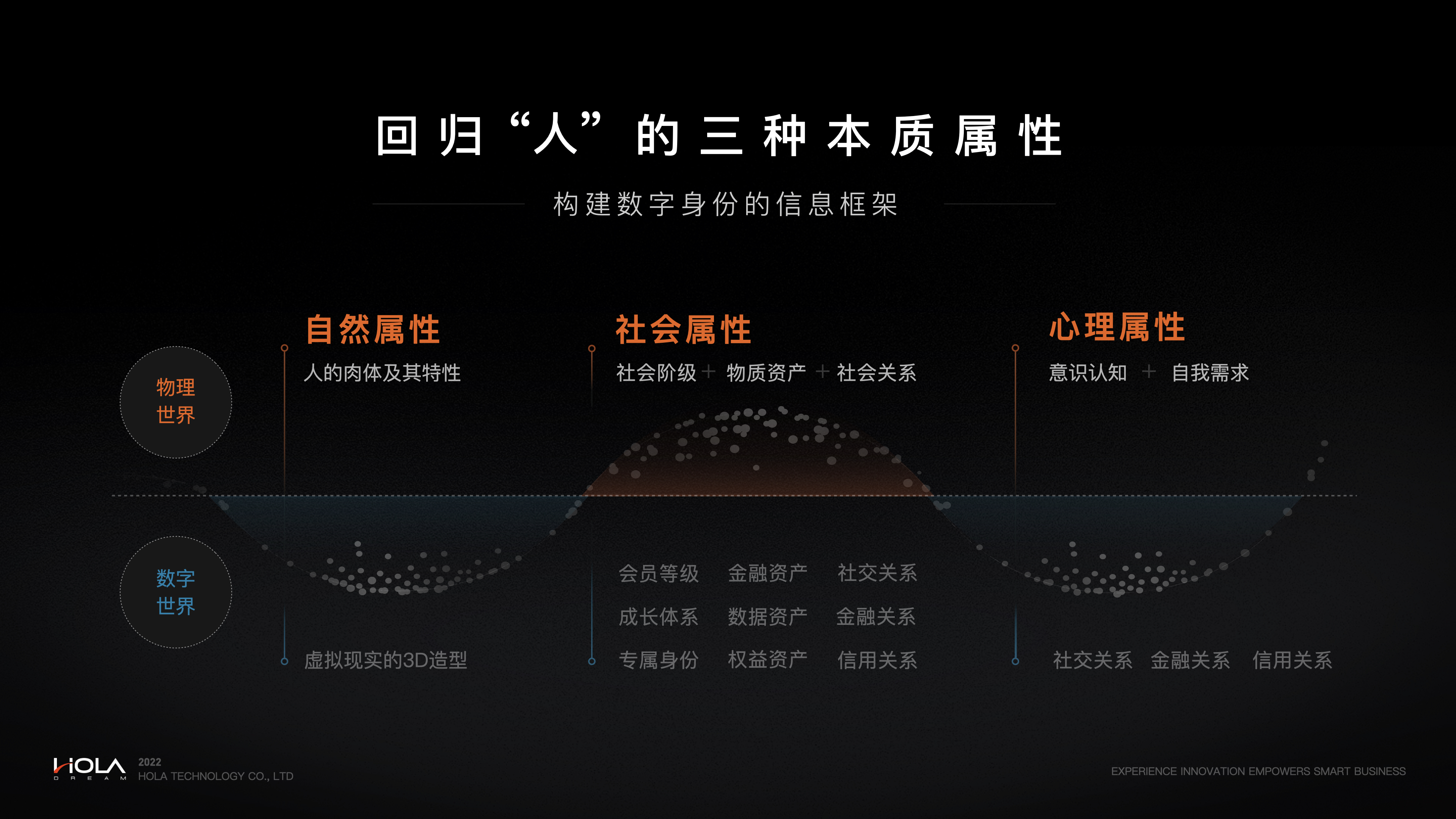

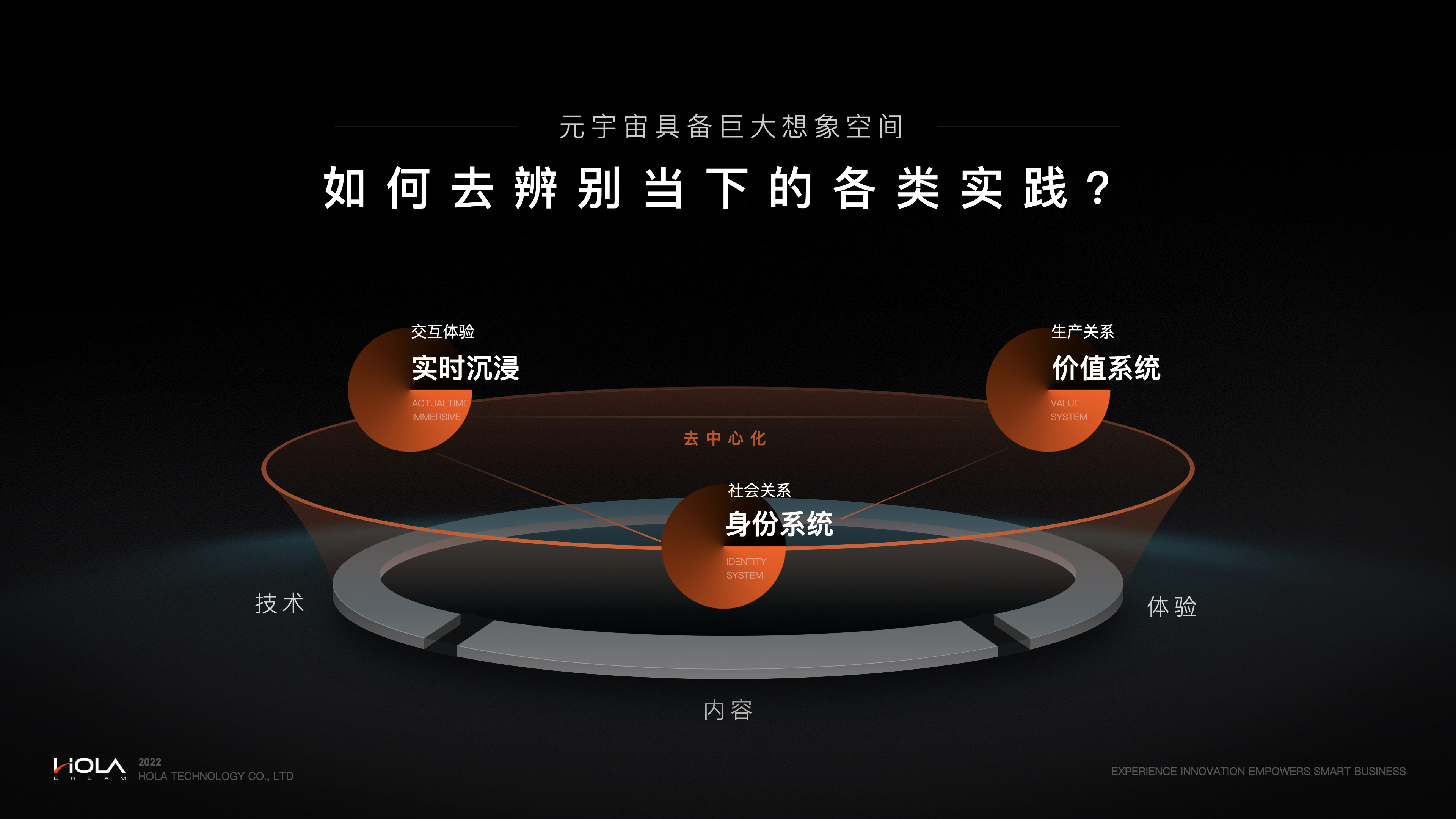

Speech 4:《From banking digitalization to metaverse, value innovation driven by experience》

Speaker:Zhao Yongchang ( HOLA,Co-founder)

Banks are integrating the original financial business into the lives of users and all aspects of business operations in a more diversified and intelligent way through digital means. "Experience" is the key word of the digital transformation of banks at present, hoping to reshape users' digital service journey through experience innovation and financial technology innovation, so as to enhance their service competitiveness. At the same time, with the continuous popularity of the concept of "meta-universe", it has opened up a new imagination space for the development of bank digitalization. In this transformation, the human imagination has been liberated from the limits of reality. Technology is innovating and thinking is innovating, but the only constant is the people-oriented core strategic concept.

This speech will focus on the theme of bank digitalization and meta-universe, and share the innovative practice of our cooperation with domestic banking institutions. In a simple way, take you into this new world of digital. To help you understand the simplest underlying logic of the metaverse and the innovative service model of financial digital from the perspective of experience. I hope that by sharing our practice, we can help experience practitioners participate in this digital economy change, create value for the digital world of virtual and real symbiosis, and realize the capabilities we are good at.

Specific contents include:

1. The digital strategy has brought about changes in the business model of traditional banks

2. Retail digital finance - around the user vision, layered, group-based experience management

3. Enterprise digital finance - reshape service relationships and help enterprises operate and manage

4. Interpret the underlying logic and user value of the metaverse from the perspective of experience

5. Practice sharing - reconstructing the "digital identity" of bank users through experiential thinking

Work Case-

Introduce gamified thinking to make digital identities flow

Introduce gamified thinking to make digital identities flow

-

Return to the three essential attributes of human beings and construct digital identities

Return to the three essential attributes of human beings and construct digital identities

-

The core key "digital identity" of mapping

The core key "digital identity" of mapping

-

How to discern the various metacosmic practices of the moment?

How to discern the various metacosmic practices of the moment?

-

1. Practitioners in the financial industry

2. User experience design manager

3. User experience designer

1. Understand the new changes in the experience design of financial products in the context of digital transformation

2. Understand the user experience design methods of various financial products

3. Understand the development trend of finance